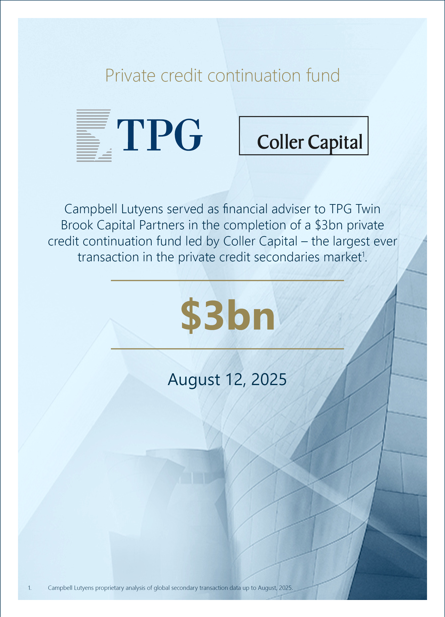

Campbell Lutyens serves as financial adviser on the completion of a $3 billion continuation vehicle between TPG Twin Brook and Coller Capital

The $3 billion credit-focused continuation vehicle, is the largest ever transaction in the private credit secondaries market.*

CHICAGO AND NEW YORK – August 12, 2025 – TPG Twin Brook Capital Partners (“TPG Twin Brook”), the middle-market direct lending platform of TPG Inc. (NASDAQ: TPG), and Coller Capital, the world’s largest dedicated private market secondaries manager, today announced the closing of a $3 billion credit focused continuation vehicle, marking the largest completed transaction of its kind to date in the private credit secondaries market.

The continuation vehicle was established to acquire a diversified portfolio of floating-rate, senior secured, sponsor-backed loans from TPG Twin Brook’s 2016 and 2018 vintage funds. The vehicle supports longterm alignment between TPG Twin Brook and its LP base by providing existing investors with an attractive liquidity option, and offering new investors access to a diversified and high-quality pool of private credit assets alongside a long-tenured manager.

It also reflects increasing institutional demand for credit secondaries, with transaction volume in the category accelerating as the broader private credit market continues to mature and expand.

The transaction supports long-term alignment between TPG Twin Brook and its LP base while enabling continued active management of its highly diversified and performing portfolio of North American middle market borrowers.

Read the full announcement here

* Campbell Lutyens proprietary analysis of global secondary transaction data up to August, 2025.